Market forecasts for the value and growth of the commercial small drone sector over the next few years have shown a slight increase in predicted annual compound annual growth (CAGR) rates between 2022 and 2030 – up from 23.3% in 2021 to 24% during 2022 – according to the latest forecasts-of-forecasts for the drone industry by Unmanned Airspace. But these high-level figures hide the market uncertainty for more complex operations, such as BVLOS missions, flights over people and more autonomous operations.

As the regulations ease to allow for more BVLOS operations demand for more commercial small UAS services should soar. But the more conservate forecasters during 2022 lowered their expectations of growth in this sector.

For example, in its 2022 survey Teal Group predicted that non-military drone production will jump from USD7.2 billion a year to USD19.8 billion by 2031, a 9.1% compound annual growth rate in constant dollars. This is down from its 14.1% CAGR 2021/2022 forecast. And in its Drone Market Analysis 2022-2030 from Drone Industry Insights, the company forecast a CAGR of 7.8% until 2030, down from a CAGR of 9.4% in its 2021 forecast. Even the US Federal Aviation Administration (FAA) – which admitted its predictions for 2020-2021 growth rates for the commercial sector of 21% CAGR was 5% lower than expected – is now predicting growth rates of between just 7% and 9% between 2026 and 2026.

| Forecaster | Market value | Years | Market | Growth rate

|

| ABI Research | USD92 billion by 2030 | 2020-2030 | Small UAS | CAGR 25% |

| Analysys Mason | USD8 billion in 2030 | 2022-2030 | Cellular connected drones | – |

| China Daily | USD14.8 billion | 2022 | All drones | CAGR 30% |

| FACT MR | USD278 billion in 2032 | 2022-2032 | Total UAS market | CAGR 25% |

| FAA | 622,055 sUAS in 2021 rising to 858,00 by 2026 | 2020-2040 | Commercial sUAS fleet | CAGR6.5% |

| Frost & Sullivan | – | 2019-2023 | Global commercial UAS fleet | CAGR 4.3% |

| DRONEII | USD30.6 billion in 2022- USD55.8

billion in 2030 |

2022-2030 | Global drone fleet | CAGR 7.8% |

| Gartner | – | 2019-2020 | Global commercial UAS fleet | CAGR 50% |

| GAI | USD58.5 billion by 2026 | 2022-2026 | Global UAV fleet | CAGR13.9% |

| Grand View | – | 2021-2028 | Commercial drones | CAGR 57.5% |

| Fortune Business Insights | USD 22.55 billion by 2026 | 2020-2026 | Global sUAS fleet | CAGR 15.92%

|

| International Data Corporation (IDC) | – | 2020-2025 | Global drone industry (including software) | CAGR 33.3% |

| MarketsandMarkets | USD27.4 billion in 2021 and USD58.4 billion in 2026 | 2021-2026 | Civil and military drone industry forecasts | CAGR 16.4% |

| Marketsand Markets | 2021-2026 | Non-military sector | CAGR 28% | |

| Teal | USD19.8 billion by 2030 | 2022-2031 | Global civil UAS fleet | CAGR 9.1% |

| Technavio | – | 2021-2025 | Commercial drones | CAGR 36.73% |

“Last year, the FAA forecasted that the (US) commercial drone sector would include approximately 589,000 small drones in 2021, a growth rate exceeding 21% over the year before (2020),” according to the US Federal Aviation Administration’s (FAA)’s FAA Aerospace Forecast Fiscal Years 2022–2042. “Actual data came in slightly over 622,000 aircraft by the end of 2021. Our forecast of commercial small drones last year thus undershot by 5% for 2021 (or 622,055 actual aircraft vs 589,463 projected aircraft). Forecasting in a time of tremendous uncertainty is indeed challenging, especially given the economic slowdown during COVID-19 and its impact on the drone sector…Using these, the FAA forecasts that the commercial drone fleet will likely (i.e., base scenario) be at around 858,000 by 2026.

The following paragraphs are edited extracts from the agency’s 2022 forecast.

“As commercial small drones become operationally more efficient and safer, according to the agency, battery life expands, and integration continues (e.g., recent final rule involving operations over people; and remote ID), new business models will begin to develop, thus enhancing robust supply-side responses… in this year’s forecast the FAA makes a provisional attempt to provide a “low” side for now, essentially capturing the intrinsic demand and making use of the calculation of effective/active fleet. In addition, we provide the likely or base scenario, together with the enormous potential embodied in the “high” scenarios, representing cumulative annual growth rates of 7% and 9%, respectively.”

According to the FAA: As noted earlier, low scenarios are driven by two positive factors (i.e., new registration and renew+) and two negative factors (i.e., cancellations and expiry). Average annual growth rate corresponding to the low scenario is determined by the combined effect of both positive and negative factors, and at present is calculated to be approximately 1.6%.

“The LAANC system began authorization in May 2017 and is designed to facilitate small drone use of controlled airspace (i.e., Class B terminal airspace) in the NAS. While most of the near-term growth in commercial small drones will continue to come from consumer grade units (over 90%), the FAA anticipates a significant part will come from professional grade small drones as well.

“Beyond the daytime operation that is presently allowed under existing part 107 rules, expanding applications further requires waivers, to a large extent, for night operations as distinct from daylight operations (around 9 of every 10 granted waivers), and operations over people (around 1 of every 20 granted waivers). As noted earlier, approved rules will now allow night operations and some operations over people as part of routine operations no longer requiring waivers. There are also beyond visual line-of-sight (BVLOS) waiver requests (around 14% of total requests) and limitations on altitude (around 11% of total requests), for which waiver approvals are granted at a rate of 3.9%. Many of these waivers are combined, and thus total waiver approvals (i.e., full + partial) granted (over 4,321 by December, 2021) exceed 100%.

“An important final metric in commercial small drones, writes the FAA, is the trend in remote pilot (RP) certifications. RPs are used primarily to facilitate commercial and public use small drone flights. As of December 2021, 254,850 RP certifications had been issued, an increase of approximately 52,000 from the same time last year (2020) and slightly higher than the year before (2019).

In terms of trying to understand how more complex drone operations will impact commercial market demand the FAA has also given figures for operations resulting from the introduction or test programmes to develop technical solutions to integrating BVLOS flights in the NAS The BEYOND programmw started on October 26, 2020. The FAA launched the UAS Partnership for Safety Plan (PSP) initiative in December 2016 to address and advance complex drone operational capabilities. Distribution of the combined flight counts and corresponding total flight hours over time are given, respectively, in the following charts: and PSP can volunteer their information which is then aggregated with UAS Integration Pilot Programme (IPP), BEYOND, and PSP information and presented in this section.

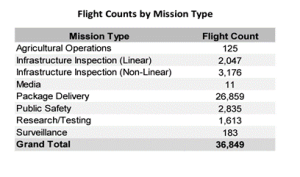

“Of around 36,850 total flights over the lives of these programmes, a large majority of the flights have been geared towards package delivery (73%), thus signifying the commercial importance of this mission. Package delivery flights are followed by infrastructure inspection, both linear and non-linear, accounting together for over 14%; and other activities such as public safety (7.7%) and research/testing (4.4%). This composition provides some guidance in terms of likely forecasts and growth trajectory of the drone sector in the near future. The table below summarizes the types of missions and corresponding flight counts aggregated under all three programmes.”

Meanwhile, according to a July 2022 report in the China Daily new service, China’s drone industry’s output value of the domestic drone market is expected to exceed 100 billion yuan (USD14.8 billion) in 2022.

“China, a key civil drones industrial base in the world, witnessed rapid growth last year, financial media outlet Yicai reported,” said the report. “Data showed there were more than 12,000 drone enterprises, with total output value topping 87 billion yuan. In Shenzhen alone, there are over 1,500 drone makers, and the output value reached nearly 60 billion yuan. Consumption-type drones accounted for 70 percent of the global total, while industrial-type drones grasped a 50 percent market share.

“Since 2020, despite the COVID-19 outbreak, China’s drone market bucked the trend and maintained a 30 percent growth thanks to contactless delivery and smart applications, Yang Jincai, director of the Shenzhen Unmanned Aerial Vehicle Industry Association, said at the 6th Drone World Congress, which was held in Shenzhen, Guangdong province, on July 23-24, 2022. This year (2022), domestic drone market value is expected to exceed 100 billion yuan, Yang said. Low-attitude public airway network is a key part of China’s multidimensional transportation system, and it is an inevitable trend to further opening-up of the low-attitude airspace in order to achieve better development of low-attitude economy.

“Compared with the highway network, there is no ready-made low-attitude airway network. Drone operators have to complete airspace application, airway plan and risk assessment by themselves, keeping a lid on low-attitude development and low-attitude economy. At present, Sichuan, Hunan, Hainan and Jiangxi provinces are pushing forward the reform of low-attitude airspace management, giving support to the large-scale utilization and commercialization of drone application.

“Data from the Civil Aviation Administration of China showed that by the end of 2021, there are 781,000 registered drone users, and the number of registered drones totalled 832,000. The world congress predicted that by 2024 domestic drone market is expected to be worth 160 billion yuan, including 45 billion yuan in geographical mapping, 36 billion yuan in agriculture, forestry and plant protection, 30 billion yuan in logistics and express delivery services, 26 billion yuan in powerline inspection and 23 billion yuan in security guard.”

“Among these, logistics is a key sector for drone applications. The government is putting more efforts to support a batch of leading companies to develop drone logistics, and release more low-attitude airspace resources, said Li Jian, former deputy head of the Civil Aviation Administration and a member of the National Committee of the Chinese People’s Political Consultative Conference. Among the 13 national pilot zones in developing drones, there are two focusing on drone logistics, and three on drone delivery in cities. Furthermore, companies like JD.com, SF Express, Meituan, ZT Express, Cainiao and China Post all put more efforts into developing large-scale logistics drones, building airway logistics network.”

Teal Group predicts that non-military drone production will jump from USD7.2 billion a year in 2022 to USD19.8 billion by 2031, a 9.1% compound annual growth rate in constant dollars. This is down from its 14.1% CAGR 2021/2022 forecast. Total civil UAS purchases will reach USD139 billion over that decade, according to Teal Group’s 2022/2023 World Civil UAS Market Profile and Forecast.

“The dynamic growth in Civil Unmanned Aerial Systems (UAS) over the period will create significant rewards for smart investment as nations open their airspace, commercial applications take off, and civil governments adopt systems for new roles in border security and public safety,” said the company’s report. “At the same time, some sectors of the market are reaching maturity faster than anticipated, requiring caution and careful research from investors and potential market entrants.”

“UAS has been a boom market with possibilities that appeared limitless. It’s now increasingly clear that the roads are diverging – some paths will lead to great reward, but on others, the cliff’s edge is in sight,” said Jeremiah Gertler, Teal Group’s lead author of the study. “Today’s heady growth will cool in some sectors after middle to late adopters finally come in. In much of the world, that will mean growth markets turn to commodity replacement markets where producers compete with the local used drone lot.”

By contrast, the United States market is expected to grow when other global markets are “already beginning to level off. “That’s the one upside of a late start,” Gertler said. “You’re running hard when everybody else is already in the showers.”

“Commercial use will drive the market as consumer drone purchases slow and government purchases remain a small but growing portion of the market. “Major corporations have been the early movers in optimizing UAS and are best positioned to take advantage when regulations finally lock in,” said Gertler. “At the same time, the consumer market skipped right through adolescence to maturity, leading UAS manufacturers to search upmarket for their next big opportunity. That means more focus on more sophisticated, higher-value units, but also more competition in narrower niches,” Gertler added.

“The greatest potential appears to be the delivery market. Teal finds the best delivery market opportunities will be in middle-mile (i.e. factory to warehouse) transportation, rather than in the last-mile deliveries that are most frequently discussed. Last-mile delivery will have to operate in the most complicated regulatory environment, with not just national bodies but localities and even homeowners’ associations having a say in whether and when delivery drones appear in neighborhoods.

“Agriculture will be the leading sector overseas by 2030 thanks to heavy Chinese investment in subsidizing agricultural drone spraying and increasingly capable but more affordable UAS moving into the sector, particularly for smaller farms.

“Industrial inspection has emerged as a major commercial drone market over the next decade. Construction will be the largest portion of that industrial inspection market. All 10 of the largest worldwide construction firms are deploying or experimenting with systems and will be able to quickly deploy fleets worldwide. Industrial inspection also includes other major segments such as energy, mining and railroads. Other important commercial UAS segments include general photography, communications, insurance, and entertainment.

“Civil governments are deploying an increasing number of unmanned systems. The United States and European governments have growing programmes to deploy systems to protect land and sea borders. The United Nations and other peacekeepers are deploying systems to provide protection. Use by law enforcement, particularly in the United States, is soaring.

“As unmanned systems proliferate, venture funding has flowed into UAS-adjacent efforts like analytical software to handle the data coming from unmanned systems and control networks. US start-ups have received a majority of the funding over the last 10 years, enabling them to take the lead in developing drone analytics. Chinese firms, which have received much less investment, are focusing on consolidating their lead in hardware, moving from consumer to commercial systems.”

In 2022, the global drone market will be worth an estimated USD30.6 billion, according to the latest Drone Market Analysis 2022-2030 from Drone Industry Insights and the updated market model forecasts a Compound Annual Growth Rate (CAGR) of 7.8% until 2030, down from a CAGR of 9.4% in its 2021 forecast.

“When analysed separately, the commercial market is set to expand at a faster rate of 8.3% while the recreational market is likely to contract in many regions,” according to the report. “However, there is still some chance that excitement around cool technology such as first-person-view drones (e.g. the recently-released DJI Avata) might provide additional boost to the recreational market. Overall, our drone market analysis shows that the market as a whole (commercial + recreational) will be worth USD55.8 billion by the year 2030.”

“This year we have expanded our forecast horizon beyond five years and all the way to 2030. Among the reasons for this is the increased maturity and security of the drone market, which makes revenues more predictable and thereby allows forecasts to become even more reliable. Additionally, there have been a lot of movements in the regulatory space, which encompass both delays as well as advances in new legislation. So, a market projection until 2030 provides a timeframe that allows for the effects of these laws to take place and for activities to ramp up and operations to be scaled once drone companies adjust to these regulations.”

The overall drone sector, including the OEM and aftermarket, is estimated to be USD27.4 billion in 2021 and is projected to reach USD58.4 billion by 2026, at a CAGR of 16.4% from 2021 to 2026, says the September 2022 market report by Markets and Markets.

North America is projected to account for the largest size of the UAV market from 2021 to 2026, whereas Asia Pacific is projected to reach the highest CAGR.

According to the report: The UAV market is facing steady growth owing to the increased use of drones in the consumer and commercial sectors, along with their popularity in the defence sector. Even though about 70% of the UAV market is expected to be connected to military endeavours, the commercial business represents the speediest growth prospect.

“Based on application, the UAV market has been classified into the military, commercial, government & law enforcement, and consumer. For this segment of UAV market, the military segment of the UAV market is projected to grow from USD12,760 million in 2021 to USD19,641 million by 2026, at a CAGR of 9.0% from 2021 to 2026. The commercial segment of the market is projected to grow at the highest CAGR of 28.0% during the forecast period; the growth of this segment can be attributed to the developments and advancements in drone technology.

“By end-use, the media & entertainment segment is expected to record high growth. The media & entertainment segment is one of the largest end users of drones. Advancements in drone technology, greater flight times and endurance, and ease of use have favoured the use of UAV for media and entertainment applications. Many media and entertainment production houses are starting to use drones as a mainstream approach to filmmaking and journalism. This is due to the availability of a huge variety of application-specific UAV in the market. The media & entertainment segment is expected to grow at a CAGR of 22.3% during the forecast period. DJI (China) manufactures drones for media and entertainment-specific applications.

“The payload segment of the UAV market is projected to grow at the highest CAGR from 2021 to 2026. By system, the UAV market has been segmented into platform, payload, data link, ground control station, and launch and recovery system. Each of them performs a different function and ensures UAV’s functioning in different applications. There are many different types of payloads that can be attached to UAVs such as cameras, infrared sensors, thermal sensors, weapons, and radars. The payload segment of the UAV market is projected to grow at the highest CAGR of 17.7 % from 2021 to 2026. The report discusses in detail six other segments of UAV market as well.

“The UAV market in Asia Pacific is projected to grow at the highest CAGR during the forecast period. The UAV market in Asia Pacific is projected to grow at the highest CAGR of 18.5% during the forecast period from 2021 to 2026. The growth of the market in this region can be attributed to the increasing demand for UAV from emerging economies such as China and India. China is estimated to lead the UAV market in Asia Pacific in 2021. The UAV market in India is also projected to grow at a significant rate during the forecast period owing to the increasing use of drones in the country for commercial applications.

According to Fact.MR’s June 2022 analysis, the drone industry is predicted to develop at a CAGR of 25% between 2022 and 2032, anticipated to reach USD279 billion. Drone technology aimed at supplying precision-based, guided weapons is causing important advancements in the defence sector, and is likely to be the backbone of global market growth, says the report.

From 2017 to 2021, the industry experienced an impressive incline at a CAGR of 23.5%. During the COVID-19 pandemic, prospects dimmed across certain sectors, including manufacturing and hospitality, while deployment for general surveillance purposes, especially to check whether individuals adhered to lockdown norms, increased dramatically.

The mix of stealth capabilities and enhanced video imagery is providing developed-country militaries with drones capable of wreaking considerable harm on enemy territory. Emerging nations and war-torn areas, such as Syria, are innovating and employing cost-cutting techniques, such as the employment of cheap, commercial quadcopters outfitted with improvised and low-intensity explosives in their military operations.

- By product, military drones to accumulate 55% market revenue in 2022

- Construction industry to emerge as an opportunistic application sector, expanding at an 18% CAGR

- U.S to account for nearly 2 out of 5 drone sales in 2022 and beyond

- China to emerge as the most opportunistic market, capturing a revenue share of 45%

- Global drone market is expected to be valued at USD30 billion by the end of 2022.

A March 2022 market study published by Global Industry Analysts (GIA) titled “UAV Drones – Global Market Trajectory & Analytics” says the global market for drones is estimated at USD33.6 billion in the year 2022 and is projected to reach USD58.5 billion by 2026, growing at a CAGR of 13.9% over the analysis period. Multirotor, one of the segments analyzed in the report, is projected to grow at a 15.2% CAGR to reach USD32.3 billion by the end of the analysis period. After an analysis of the business implications of the pandemic and its induced economic crisis, growth in the fixed-wing segment is readjusted to a revised 14.1% CAGR for the next 7-year period. This segment currently accounts for a 27.3% share of the global drones market. Globally, the market for multirotor drones is being driven by their increasing use in a number of non-military applications, specifically by law enforcement agencies. Demand for multirotor UAV drones is also being fostered by continuous advances in commercial and military technologies.

However, as the COVID-19 catastrophe struck, industrial activity around the world slowed down resulting in a decline in demand for drones. Since demand is driven by end-use industries that use drones primarily for procurement purposes, curbs on non-essential industrial activity caused demand to plummet. Despite the tepid short-term prospects, increased investments in technology are expected to fuel long-term market growth. Though somewhat restrained presently, the demand for drones would continue to be driven by increased demand for data (drone-generated) in commercial applications and key technological advancements, as well as expected venture funding in UAV drones. The current pace of technological developments is expected to open new avenues for increased adoption of UAV drones for an extended number of applications across both military and commercial sectors.

The drones market in the U.S. is estimated at USD10.2 billion in the year 2022. The country currently accounts for a 30.7% share in the global market.

China, the world’s second largest economy, is forecast to reach an estimated market size of USD11 billion in the year 2026 trailing a CAGR of 18.7% through the analysis period. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 11.4% and 14.3% respectively over the analysis period.

Within Europe, Germany is forecast to grow at approximately 12% CAGR while Rest of European market (as defined in the study) will reach USD13.2 billion by the end of the analysis period. In the last decade.

For the global single rotor segment, USA, Canada, Japan, China and Europe will drive the 11.8% CAGR estimated for this segment. These regional markets accounting for a combined market size of USD3.7 billion will reach a projected size of USD8.1 billion by the close of the analysis period. China will remain among the fastest growing in this cluster of regional markets. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach USD1 billion by the year 2026.

Cellular connected drones are set to become a major growth segment in the drones market. According to a 2022 report by Analysys Mason, the total revenue generated by cellular connected drones worldwide will grow to USD8 billion in 2030.

According to the company press release, cellular network is most commonly the native connectivity method deployed with most cell phones, smartphones, and dial-up devices. It’s a mobile-based network used with a radio antenna.

Cellular connectivity presents major opportunities to the use of drones – if those deploying them can adapt on how their drones are operated. Beyond just connectivity, cellular connected drones allow the creation of network-based products and services – something of ever-increasing interest.

Early examples of what can be accomplished are still rare, as the technology is nascent. In late 2021, however, one case study saw Skyward and Verizon partner with French drone company Parrot to announce Parrot ANAFI Ai — the first off-the-shelf drone with Verizon network connectivity.

The model includes not only a 4G LTE connection, but many other powerful features including advanced encryption for data storage and transmission, a 48-megapixel camera capable of taking 4K ultra high-definition video, and omnidirectional obstacle-avoidance technology to intelligently dodge hazards in all directions.

In the future – should legal changes allow for it – this could allow users to command drones in distant locations. In this case, cellular connected drones could revolutionise the transport and supply chain industry, shifting huge quantities of goods over all kinds of terrain quickly and safely.

It is this kind of potential that has led consultancy Analysis Mason to forecast that the total value chain revenue generated by cellular connected drones worldwide will be more than USD8 billion in 2030. According to the researchers, USD1.5 billion of this will come from connectivity.

Connectivity revenue generated by cellular drones worldwide sat at USD11.1 million in 2020, but as cellular drones produce far more data traffic than typical IoT connections, they will therefore generate a considerably higher average revenue per connection (ARPC). Analysys Mason predicts that operators will generate most drone-related connectivity revenue from selling various services. These include basic drone tracking; routing services to ensure flight path adherence; and real-time transfer of the data generated by the drone payload (such as HD, 4K and/or thermal cameras and sensors).

Ibraheem Kasujee, an analyst with Analysys Mason and author of the report, commented, “The most significant revenue opportunities related to cellular drones will only be available to operators that provide services to the aviation sector. However, drones still represent an interesting opportunity for other operators. They can use the drone market to develop and showcase their 5G and edge computing capabilities, or to develop new capabilities that they may have little experience with in the IoT realm (such as professional services). Drones are also highly marketable and operators may use them to improve their brand and achieve their ambition of becoming known as data service and platform providers.”

Meanwhile in August 2021 Coherent Market Insights published its forecast for the global market for delivery drones. According to the company, this is expected to be valued at USD5.6 billion by 2028, at a compound annual growth rate of 41.3 percent over the forecast period (2021-2028),

The report says companies like Google, Uber, Matternet, Aria Insights and UPS are focused on adopting drones for package deliveries. Furthermore, increasing use of delivery drones in various industries such as healthcare, food, and others is driving growth of the global delivery drones market. The outbreak of Covid-19 has positively influenced the global delivery drones market growth, where the pandemic has increased demand “to deliver goods to the customer without human involvement.”

Amongst the different types of drones, rotor-powered gained the highest market share last year and is expected to retain this share over the forecast period, “owing to flexibility in operation, ease in use, and low maintenance cost.”

Furthermore, increasing demand for delivery drones from commercial, residential, healthcare, and other sectors are expected to boost growth of the segment.

Asia Pacific is the fastest-growing region in the delivery drones market. The growth of this area is mainly attributed to the presence of China and India.

The fast-growing economies in this region offer growth opportunities and why, major online retail companies are looking forward to reducing their transportation time by using delivery drone.

The conclusions of the 2020 Global UAS Ops survey, conducted by Blyenburgh & Co in the context of the EU-funded AW Drones project suggested that in the near future a significant decrease in visual line of sight (VLOS) operations (42% to 25.7%) will take place and a significant increase in BVLOS (from 19.8% to 34.2%) will take place.

Source: Blyenburgh & Co

According to Business Insider (https://www.businessinsider.com/drone-industry-analysis-market-trends-growth-forecasts?r=US&IR=T) the drone services market size is expected to grow to USD63.6 billion by 2025. Sales of US consumer drones to dealers surpassed USD1.25 billion in 2020, according to Statista. Goldman Sachs forecasts the total drone market size to be worth USD100 billion—supported by this growing demand for drones from the commercial and government sectors. According to the April 2021 Commercial Drone Market Size, Share & Trends Analysis Report By Product from Grandview Research: “The global commercial drone market size is anticipated to reach USD 501.4 billion by 2028, registering a CAGR of 57.5% from 2021 to 2028.”

In October 2020 Global tech market advisory firm ABI Research predicted the sUAS industry would be worth USD92 billion by 2030, with a CAGR rate of 25% between 2020-2035. Of this revenue, 70% is in the commercial sector (USD63 billion). “The largest number of drone registrations are currently in the USA, where the FAA tracks 1.7 million consumer drone pilots and 400,000 commercial operators. China is catching up with 400,000 registered drones, while the European Union (EU) has over 1 million registrants. Among the biggest markets are security and industrial inspection, with growing opportunities in delivery, agriculture, and emergency services.”

“We have gone through various phases of the drone industry, from its genesis in the military, to the proliferation of consumer drones. Since Chinese developer DJI monopolised that space, the attention has shifted to commercial applications,” explains Rian Whitton, Senior Robotics Analyst at ABI Research. “While some of the initial hype has subsided, providers and end users are refocusing on developing the necessary supporting infrastructure and services to make drone technology viable at scale.”

In April 2020 Frost & Sullivan published its latest market analysis for the global commercial drone sector, Global Commercial UAS Market Outlook, 2020, concluding that the industry is transitioning from a nascent to a growth stage. “With the surge in demand for commercial drones by the professional segment, unit shipment is estimated to rise at a compound annual growth rate (CAGR) of 4.5%, reaching 2.91 million units by 2023 from 2.44 million units in 2019. By 2023, North America will remain the largest market for commercial UAS with a total of 32.3%-unit demand, followed by APAC and Europe at 29.1% and 23.3%, respectively.

In 2020, worldwide shipments of Internet of Things (IoT) enterprise drones will total 526,000 units, an increase of 50% from 2019, according to market forecaster Gartner, Inc. Global shipments are forecast to reach 1.3 million units by 2023.

Source: Gartner

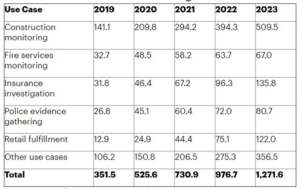

“The construction sector is an early adopter of drones, which causes construction monitoring to be the largest use case by shipments worldwide across the forecast,” said Kay Sharpington, principal analyst at Gartner. “Shipments are estimated to reach 210,000 drones in 2020, and more than double by 2023. Drones are taking over tasks such as site surveying and earthworks management as they are faster and safer to carry out with a drone than on foot.”

To save costs when surveying sites, the number of global construction employees per drone will decrease from 2,400 to 640 between 2018 and 2020.

According to the company: “In the short term, most use cases will be based around surveillance and monitoring due to the technical complexity of other applications. In 2020, the second and third use cases by drone shipments will be fire services monitoring and insurance investigation. The insurance industry is the second largest use case by shipments with 46,000 drone shipments forecast for 2020. Shipments are expected to nearly triple by 2023, to reach 136,000 that year.

“Drones are used to carry out inspections on buildings and structures after a claim has been made, to assess the extent and cause of the damage. They can also be used to evaluate the type and condition of the building when providing an insurance quote,” said Ms. Sharpington. “Their benefits are valuable. For example, they reduce the cost of scaffolding, ladders and employee time and provide a comprehensive photographic record of the building condition.”

To survey claim areas at a lower cost, Gartner expects insurance drones will grow from one per 152,000 people in 2018 to one per 72,000 people worldwide in 2020.

Police and firefighting agencies globally are deploying drones in public safety operations, wildfire management, crime scene investigation, and search and rescue operations. Gartner estimates that the number of drones used by police and firefighters will grow from one per 210,000 people to one per 47,000 people between 2018 and 2020.

“Fire service drones use cameras and thermal imaging to identify fire sources, extreme heat areas, trapped people and the positions of firefighters in the field,” said Ms. Sharpington. “Consequently, firefighting agencies can deploy resources in the right areas in emergencies and investigate incidents while minimizing risk to lives.”

Drones used for retail deliveries will provide customers with rapid service and allow retailers access to customers in remote areas. However, the regulatory restrictions and logistical challenge of coordinating flight paths, managing airspace over densely populated areas and managing various payloads means that retail, overall, is a longer-term opportunity for drones.

Drone shipments will total 25,000 in 2020 and will rise to 122,000 units in 2023. Following this predicted trajectory, the biggest opportunity for retail will come after 2023. In addition, Gartner estimates that the number of employees per drone will decrease from 73,000 global retail employees per drone in 2018 to 18,000 global retail employees per drone in 2020.

A study by Fortune Business Insights published in March 2020 expected the small drone market to increase from USD6.46 billion in 2018 to USD22.55 billion in 2026. The company’s Aerospace & Defense division says this reflects a compound annual growth rate (CAGR) of 15.92% over the forecast period.

A summary by Fortune Business Insights reports North America as the largest market, due to growing investments in the small drone by several business firms and rising research and development. Border surveillance and maritime surveillance is also boosting the market.

The Asia Pacific meanwhile shows fastest growth rates, attributed to high demand from emerging economies including China, India and Japan. China is the lead manufacturer of drones and has a wide range of applications and strong domestic policy which supports usage of small drones.

Growth in Europe is also strong, with the UK revealing one of the largest fleets of small drones. The Middle East represents considerable growth opportunity and commercial applications are emerging in Africa and Latin America.

The study looks in-depth at market size, market drivers, segmentation, application, analysis by region, and lists key players with an analysis of market dynamics and the competitive landscape for manufacturers of small drones. The study is called: Small Drones Market Size, Share & Industry Analysis, by Type (Fixed-Wing, Rotary-Wing, and Hybrid/Transitional), By Power Source (Lithium-ion cells, Hybrid Fuel cells, and Solar cells), By Size (Micro, and Mini & Nano), By Application (Civil & Commercial, Military, Homeland Security, and Consumer) and Regional Forecast, 2015-2026.

According to a September 2020 study published by Polaris Market Research the commercial UAV market is anticipated to reach over USD 15,624.7 million by 2026. In 2017, the rotary blade UAV segment dominated the global market, in terms of revenue. North America is expected to be the leading contributor to the global market revenue during the forecast period.

According to a company press release:

“The increasing applications of commercial UAVs in industries such as agriculture, media and entertainment, and mining have boosted the growth of the market. Use of UAVs in performing high risk tasks further support the growth of this market. Additionally, the technological innovation in the market in terms of miniaturization & improvement of components further boosts the adoption of commercial UAVs. Increasing investments by vendors in technological advancements coupled with decreasing prices of components would reduce the overall cost of UAVs in the coming years, further supporting the market growth. However, security and privacy concerns are expected to hamper market growth during the forecast period. Growing demand from emerging economies, and increasing awareness are factors expected to provide numerous growth opportunities in the coming years.”

(Image:Shutterstock)