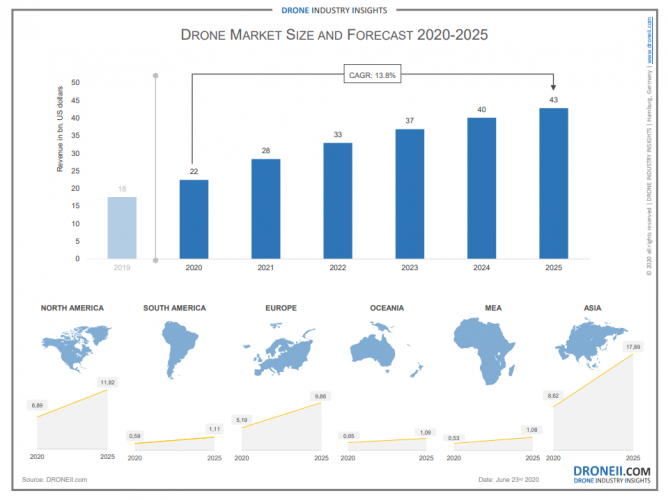

The DRONEII five-year forecast for the drone market predicts the market will grow from USD22.5 billion in 2020 to USD42.8 billion in 2024 at a compound annual growth rate of 13.8 per cent. DRONEII says by 2021, the commercial drone industry will be selling 1,000,000 drone units per year. Looking at the growth between 2020 and 2025, unit sales will have more than doubled in this time period. Notably, while overall drone unit sales will increase this will be down to commercial drone unit sales growth as private or hobbyist drone unit sales will decrease in 2020-2025.

The report includes the global drone market size, shares and forecast for 2020-2025 broken down by segment, industry, application method, region, country and more, as well as drone market unit sales. It also includes an outline of drone regulations as well as key micro, macro and mega trends affecting the drone industry in the future.

According to DRONEII, this fairly stable year on year growth is a reflection of the ongoing high investments and the consolidation of the commercial drone market. It is a less optimistic picture than the company forecast in 2019, but nevertheless shows that the commercial drone industry remains resilient in spite of emerging challenges. The drone industry has matured from explosive and exponential growth to steady returns, increased adoption and a step up from the so called trough of disillusionment.

DRONEII says the energy sector is the largest industry on the commercial drone market in 2020 and will continue to be so in 2025. However, the transportation & warehousing industry will continue to be the fastest growing. This is partly because, as defined by the North American Industry Classification System (NAICS), this vertical includes industries providing transportation of passengers (although air taxis still will not sell for some time) and cargo, warehousing and storage for goods, and support activities related to modes of transportation like inspection and maintenance of infrastructure. While agriculture and construction currently follow energy as the top industries in the drone market, the growth of the transport sector will mean that by 2025 it will be the 2nd largest industry within the market.

Currently, the national drone markets in US and China currently dominate the commercial drone market – together their revenue makes up over two thirds of the global drone market size and this does not look likely to change in the foreseeable future. However, regional shifts in drone market dominance have been more common. While back in 2018 North America was generating slightly more revenue than Asia, thanks to the growth of not only China, but also Japan and especially India (since the legalisation of drones there in December 2018), Asia pulled ahead already by the end of 2019. The region will continue to build on this growth and be the leading regional market by some margin in 2025.

The COVID-19 global health crisis has resulted in a worldwide contraction of several markets as almost three months of respective quarantine in major economies has seen major rises in unemployment, slowdowns of supply chains and reduction in demand for goods.

However, it is important to note that the commercial drone has also already made gains during the pandemic – thanks to medical applications of commercial drones amongst many other automated solutions provided (mapping, surveying, broadcasting etc.) drone companies like Zipline and Wing have been able to deliver and scale their solutions quicker than previously expected. As a result, the industry as a whole is likely to feel the economic effects of the pandemic, says DRONEII.

For more information visit: