GSMA Intelligence has today launched a new report revealing that the UK is falling behind other global players in the race for drone innovation. The report, commissioned by BT Group, outlines how the UK must learn from international peers and lays out recommendations which could help guarantee the UK is a leader in the drone economy if acted on within the next year.

According to a press report:

“The research, supported by BT Group, found that many of the UK’s international partners, including Japan, Switzerland, France, Germany and Italy have seen their drone ecosystems develop faster due to established regulatory systems and infrastructure. The UK currently sits at the middle ‘drone readiness’ index, with Switzerland taking the leading position and the US the bottom of the table reflecting slower progress in drone regulatory rules.

“With drones potentially contributing £45 billion to the UK economy and supporting 650,000 jobs by 2030, following the report’s recommendations has transformative potential for both the public and private sector.

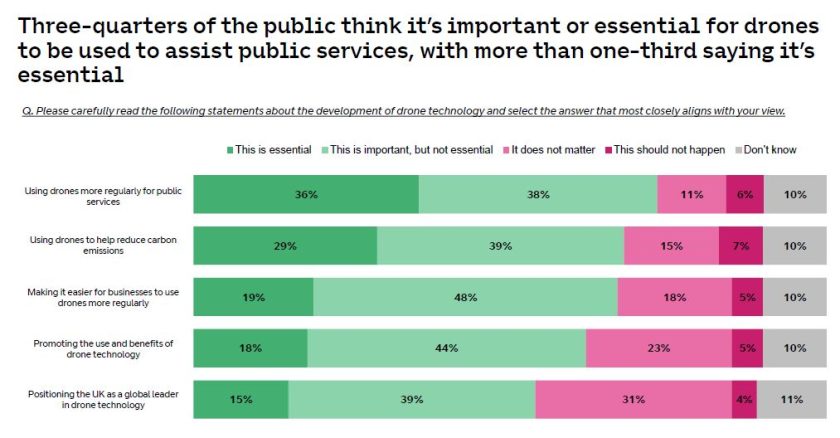

“A separate poll for BT Group* found that 75% of consumers believe that it is essential for drones to be used for public service delivery, and two thirds agreeing that drones could have a positive impact on their lives. In this context, the UK now has a window of as little as 12 months to facilitate greater investment and technological development, or risk falling behind.

“To increase drone readiness in the UK and win the race to the top, the report outlines four key recommendations for the UK government, the UK aviation regulator, the Civil Aviation Authority (CAA), and other relevant agencies:

- Facilitating permissions for safe, remotely piloted drone flights at scale: Beyond Visual Line of Sight (BVLOS) drone capability underpins a successful drone industry and its applications. Although the UK has a BVLOS policy, it was found to be confusing and unclear among the raft of companies and start–ups testing or seeking deployment of their services at scale. The implementation guidelines need to be simplified and modernised. And a supporting regulatory framework that includes Unmanned Aircraft Traffic System Management (UTM), safety standards and training – must be a priority.

- Enforce pro-innovation regulations and a pro-growth regulatory culture: The (CAA) must formulate workable regulations that promote investment in a timely manner, while ensuring safe operations and delivering public confidence in the industry.

- Extend the Future Flight Challenge: The UK has many innovative companies in the drone sector that need a say in regulatory development. The flagship Future Flight Challenge, which the government has funded, has been a clear help and stimulus to private sector innovation and so this, or a related scheme, should be extended.

- Act now: The UK has a window that is as narrow as 12 months to set the regulations and guidance that will help the sector thrive. The study found that many advanced economies expect drone regulations to be in place by 2024–2025, a date that the UK must also meet to remain competitive in developing home-grown technology for domestic use and in export markets.

BT Group’s research also reveals that there is strong consumer demand for drone capabilities from a wide range of industries such as utilities, public services, manufacturing, last-mile logistics and distribution, conservation and land/forestry management, film and TV sectors.

For more information