The February 2025 update to the Global AAM/UAM Market Map report: The global vertiport market map and forecast 2025-2029 has identified 1,504 vertiports being planned for development around the world, or implicit in the network launch plans of eVTOL operators.

This is an increase of 500 over the September 2024 report. It will cost USD1,554.2 million to build these vertiports and equip them with aviation focused technology. However, it is likely that eVTOL programme failures and regulatory delays will trim this figure to a more likely 980 vertiports to be built between 2025-2029.

This is still a huge figure, given that in 2024 construction began on just 24 vertiports globally. This includes the Far East and in particular China, where government-managed “low altitude economy” developments by regional transport organisations plan for over 100 vertiports to be built in Guangdong province by 2027 alone.

“We have identified every vertiport programme in the public domain currently planned or underway and estimated vertiport requirements from advanced air mobility aircraft operators who have shared their route plans,” said Philip Butterworth-Hayes, the author of the report. “It has been an exercise in understanding which programmes are real and which are unlikely to ever see the light of day. We have also taken a look at the market share of the major players and seen some huge changes here over the last few months.”

The biggest growth area is in the Far East, and China in particular, which now accounts for more than 50% of all vertiport projects, planned and committed; over the last five months 388 new vertiport programmes have been added in China. In November 2024 Shenzhen pledged to invest 12 billion yuan (USD1.7 billion) in infrastructure for the low-altitude economy over the next two years, building over 1,200 take-off and landing platforms for air taxis and drones by 2026. In contrast, North America has announced 43 new vertiport plans in the last five months and Europe just three.

For more information in the report, including extracts, please visit here. If you want to discuss the results of our research in more detail please contact the author of the report at Philip@unmannedairspace.info.

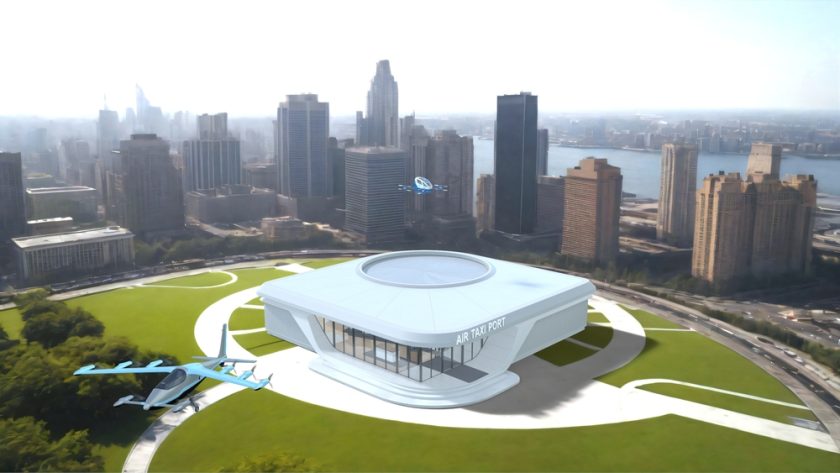

(Image: Shutterstock)