The “Unleashing American Drone Dominance” presidential executive order of June 6 has accelerated the momentum towards advanced air mobility (AAM) commercial operations in the USA. But are US states, cities and airports ready to host eVTOLs? Which locations have developed AAM strategies and begun the hard work of planning for vertiports, vertiport support services and the air traffic management systems which will be needed for these operations?

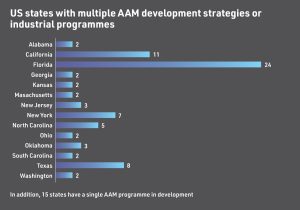

There are now 92 AAM infrastructure programmes planned or underway in the USA, according to the latest North American Regional Report within the Global AAM/UAM Market Map service, which identifies details of every UAM/AAM route and infrastructure programme in the world, the sites where vertiports are planned, the routes where eVTOLs will fly and the partners in each programme. “There are 14 US states (see table one) where two or more vertiports are planned to be built in the next three years and a further 15 states where AAM strategizing has begun and/or at least one potential vertiport site has been identified,” said Philip Butterworth-Hayes, author of the report.

“Predictably, the warm, flat lands of Florida, where large urban areas are placed conveniently close to one other within eVTOL range, is by far the most active state with 24 AAM sites at various levels of maturity underway. The training of Florida state local government officers in AAM infrastructure development has been underway for some time. California and Texas are next, followed by North Carolina.”

The survey shows that across the USA, states, cities and airports are starting to embrace AAM in a more structured way. The number of overall planned AAM sites has increased overall by 31 since the start of this year, even after the failure of Lilium – which had developed an extensive network of destinations in Florida – has been taken into account.

“Defining in detail levels of preparedness is difficult as there is a huge gap between developing a high level AAM strategy and determining exactly how many litres of foam and the training requirements will be required to deal with an eVTOL battery fire at a regional airport,” said Butterworth-Hayes. “But the aviation hubs of Chicago, Dallas, Los Angeles, Miami, New York and San Francisco are already a long way along the path to defining the requirements in detail for eVTOL commercial operations.”

Currently there are eight sites in the USA which are preparing for the imminent arrival of AAM operations. So where will the first commercial AAM programmes lift off in the USA?

The FAA is expected to certify the first passenger carrying eVTOLs for revenue service in 2026 and several cities are vying to be the first operators. In pole position is New York, where in April 2025 the New York City Economic Development Corporation (NYCEDC) unveiled “Downtown Skyport,” formerly the Downtown Manhattan Heliport (DMH), as the initial hub for eVTOL operations there. Both Blade (Beta eVTOls) and United Airlines (Archer eVTOLs) have announced plans for early operations while a few minutes flight time away in New Jersey at the Kearney HHI heliport Delta (Joby) and FlyNYON (Beta) will also provide early commercial services. Low level airspace above Manhattan is like to be very crowded very soon.

Supernal, Joby, Eve and Archer have all declared their interest in prioritising Miami as an early US UAM hub while Joby, Eve and Archer are developing plans for route networks centred on San Francisco.

So the next hurdle will be for local authorities and the FAA to work out how to integrate these different industry groups into common ecosystems, so different charging, vertiport infrastructure and traffic management systems can become aligned. It is not yet clear how and whether competing industry groups will allow access to their facilities by rivals and what the costs for this might be.

The Global UAM/AAM Market Map North American Regional Report also highlights the very different eco-system characteristics and route-lengths that are being planned for these emerging AAM hubs. For example, the city/suburban eVTOL services in and around Dallas have an average route length of 18km, according to the study findings. In Chicago, average route lengths are 38km and in San Francisco, the average figure is 60km, as the networks planned by eVTOL operators encompass many of the surrounding Bay communities.

“There is a clear pattern emerging of the US advanced air mobility industry developing infrastructure provision along the lines of business aviation in the USA, with dedicated terminals and FBOs,” said Philip Butterworth-Hayes. “That works in the initial stages of commercialisation where operations are centred in public use airports and heliports. However, when vertiports start to emerge in urban centres, this model might not hold as the scarcity of land available and the greater involvement by local authorities in enabling city-centre transport hubs will make it more likely that these facilities will be available to a wide range of eVTOL operators.”

The Global AAM/UAM Market Map is a unique industry resource, giving users a complete view of every government, city, airport and industry plan for new AAM services around the world, highlighting the market opportunities and the competitive partnerships developing in real-time. Together with The Global Vertiport Map and Forecast and The AAM regulations, standards, CONOPS and roadmaps for passenger-carrying operations guide, the Global AAM/UAM Market Map gives subscribers a detailed insight into key market drivers and opportunities in this important emerging industry unavailable anywhere else. To learn more about this resource please contact the editor Philip Butterworth-Hayes at Philip@unmannedairspace.info.