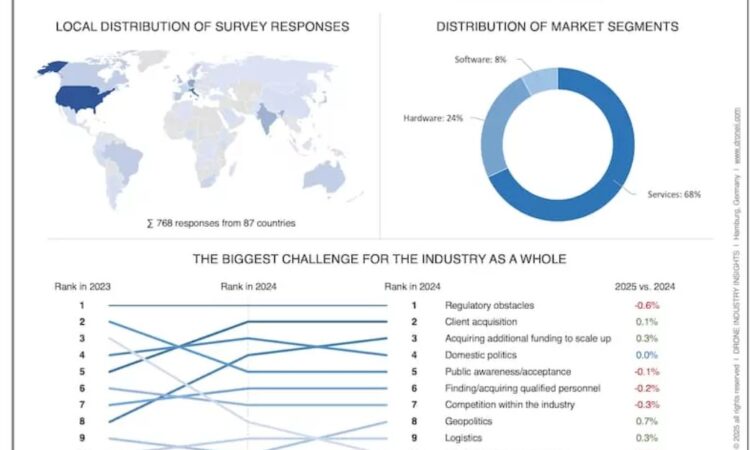

Drone Industry Insights (DII) has published its latest Global State of Drones 2025 report. “Just as last year, the service sector remains the largest, accounting for 68% (-6% from 2024), followed by hardware companies at 24% (+6%), and software companies at 8% (+/-0%),” according to the report.

“Mapping and surveying remain the primary methods for drone applications, used by 35% of all drone operators, followed by inspection (26%) and photography and filming (18%). Growing shares are also reported for methods like spraying and dispensing (7%), delivery (7%), and localization and tracking (5%).

“In 2025, the top reason for using drones is “saving time,” followed by improving quality. This marks a major shift from the previous year, when “improving work safety” was almost always the top reason. This could indicate that drone solutions need to deliver on their promises, and streamlining the whole process (not just data collection) becomes more crucial.

“Regulatory obstacles remain the top challenge for the drone industry in 2025, marking the third consecutive year.

“Example USA: Drone regulation remains one of the most persistent challenges in the industry due to the high costs and complexity of achieving and maintaining airworthiness. While FAA Part 107 provided a regulatory foundation, its reliance on individual waivers created an inefficient and resource-intensive approval process. The newly proposed FAA Part 108 aims to address these issues for BVLOS operation by introducing risk-based flexibility, shifting certain responsibilities to industry standards, and better aligning with international frameworks such as those of EASA and Japan. Although expectations are high, it remains uncertain whether Part 108 will fully resolve the regulatory bottlenecks that have long hindered the industry’s growth.

“However, notable shifts have occurred in other areas. While client acquisition stays in second place, acquiring additional funding is becoming a real problem. With regulations limiting operational scalability and clients hard to onboard, additional funding is the only way to occupy certain niches and outperform competitors. With funds drying up, the challenge is only increasing – just as the ranking this year has moved to third position (2023: rank 8).

“Some challenges have decreased over the years, like public awareness and inflation, which is somewhat reassuring. The main question is, what impact will these challenges have on the industry, how will drone companies respond, and what will the drone landscape look like in 2-3 years?”

This year, 768 completed survey forms were submitted from 87 countries. The majority of answers came from Europe (46%), followed by North America (19%) and Asia (18%).