DroneShield Ltd has announced the release of its 2025 Total Addressable Market (TAM) Report for Counter-Uncrewed Systems, which provides an analysis of the rapidly expanding global counter-uncrewed systems (CUxS) sector. The report estimates the total addressable market for CUxS technologies at USD63 billion.

“The valuation highlights the significant and growing size of the CUxS market, shows the still ‑nascent customer saturation point, and a pivotal market shift: counter-drone technology is no longer confined to the battlefield,” said the company in a press release. “ As drones move from recreational use to criminal activity and sophisticated military operations, the demand for effective countermeasures has become a mainstream global security priority. This transition marks the emergence of CUxS as an essential layer of protection across military, government, and civilian infrastructure.”

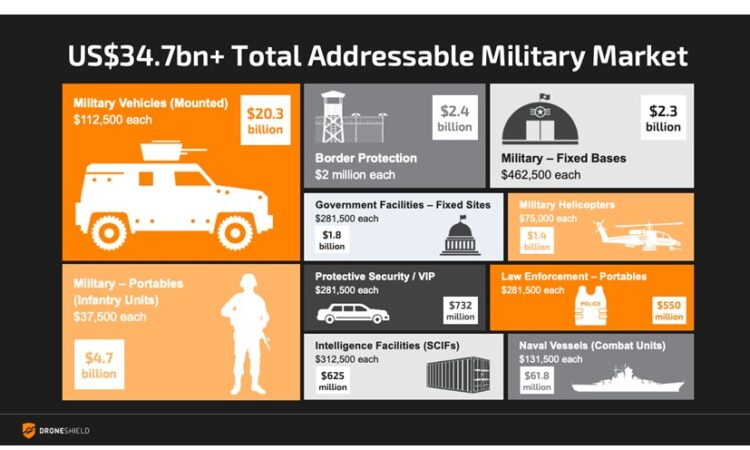

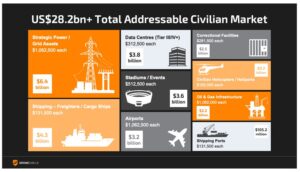

Military, government, and law enforcement account for USD34.7 billion (56 percent of TAM) and civilian agencies USD28.2 billion (44 percent of TAM), said the company.

“Military requirements continue to drive the need for mounted and portable CUxS solutions for vehicles, bases, naval vessels, and aircraft. Civilian demand, meanwhile, has accelerated across airports, energy grids, data centres, correctional facilities, and public venues, sites increasingly exposed to both inadvertent and deliberate drone incursions.”

Counter-drone technology has moved from a niche military capability to a critical component of national and civil security infrastructure,” said Oleg Vornik, CEO, DroneShield. “This data reinforces that counter-drone demand is broadening beyond the military sector into every major sector that depends on airspace integrity. Additionally, this highlights how early we are in the adoption cycle – all of our military customers are only starting mass procurement at this stage, and the civilian customers have a substantial amount of catch up to do, to enable the protection against this rapidly growing threat, as the most recent drone disruptions across multiple countries in Europe have demonstrated.”

DroneShield’s TAM model applies a bottom-up, category-based methodology, leveraging operational data from deployments in more than 40 countries. The analysis provides quantitative insights into the size composition, and projected trajectory of the CUxS market, offering governments, enterprises, and investors a data-driven view of how airspace security is becoming a core element of national resilience and operational continuity.

For more information

https://static1.squarespace.com/static/660a32624c94dd36e509baf3/t/68ef78f1b331d33c703188bd/1760524529162/2025+Total+Addressable+Market+Report.pdf

| The Unmanned Airspace 2025 Global Counter-UAS Systems Directory is the world’s only comprehensive, updated directory of global C-UAS companies and systems. It itemises over 1,000 C-UAS products and services with performance details, company sales and partnerships arrangements. It is updated every month and broken down into niche sub-sectors (net-capture, missiles, intercept drones, detectors etc) to give C-UAS procurement and industry personnel a unique perspective of global C-UAS technical capabilities and market positions. It is available in word, PDF and excel formats and Unmanned Airspace readers are eligible for a range of discounts. For more information about the Directory please contact the editor Philip Butterworth-Hayes at philip@unmannedairspace.info. |